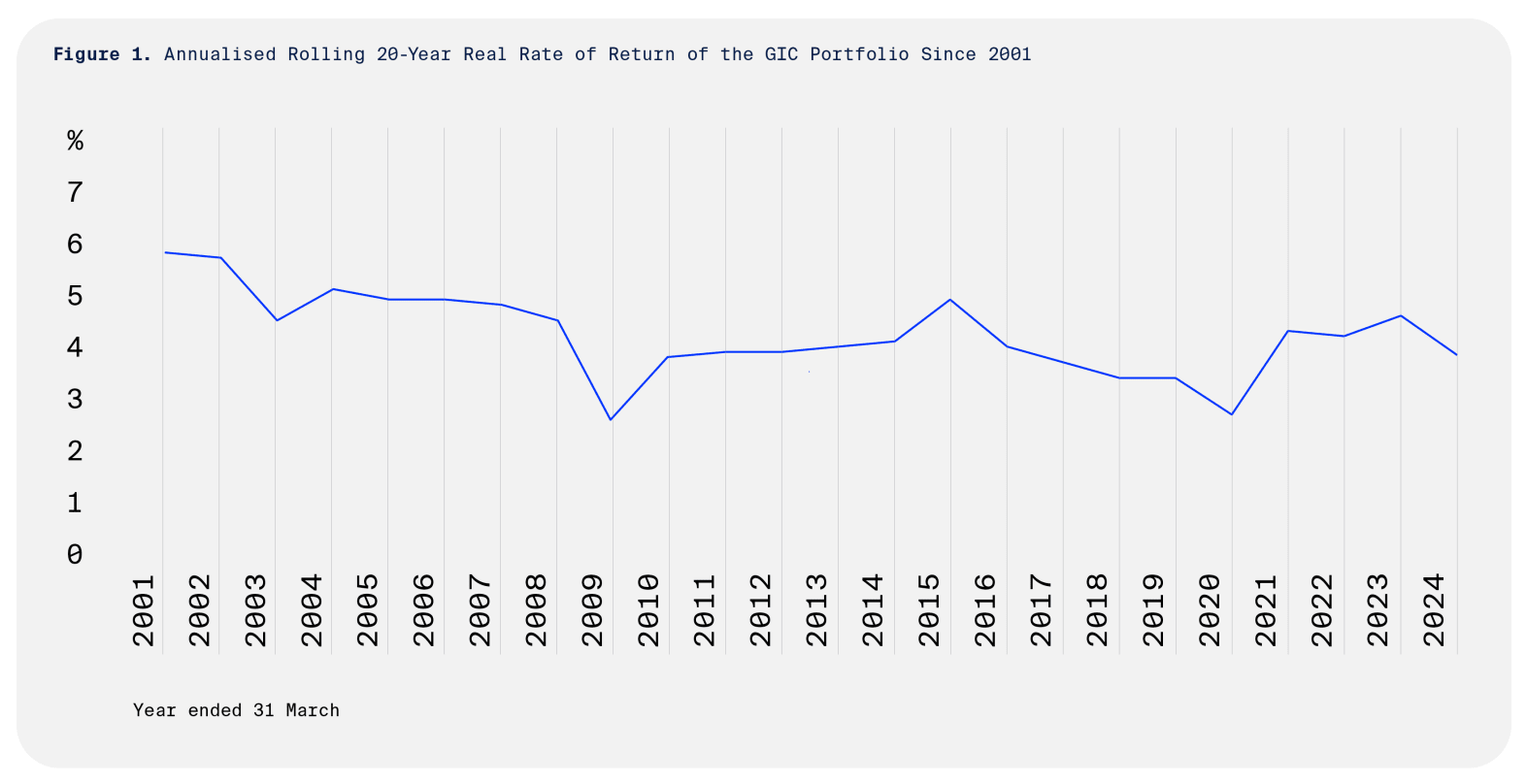

In its 2023/2024 annual report released on Wednesday (Jul 24), GIC said its 20-year annualised real rate of return stood at 3.9 per cent for the year that ended on Mar 31. This was down from the 4.6 per cent reported last year, which was the highest return since 2015.

The 20-year metric - a primary indicator of GIC’s performance - is a “rolling” return in which years are dropped and added as the computation window moves.

Above is copied from CNA. Singapore has invented a new way of measuring the performance of its national fund managers. Instead of comparing their performance year by year, this year over the previous year, Singapore is measuring their performance over the long term, 20 years for now. They may change it to 100 years if they need it suits their interest in the future.

This new methodology has many advantages over the old one. The most immediate impact is the payment of performance bonus. In the previous method, performance and reward were based on profits made this year over last year. Losses, never mind, no bonus or little bonus. Given the fact that there are a lot of fluctuations in the economy on a year to year basis, the percentage of change from one year to another can be extremely high, leading to huge payments of bonuses in one year and negative bonuses the next when the fund suffered great losses but unable to plough back the huge bonuses paid the year before.

A 20 year performance model would even out the big swings in performance and also the payout. The fund managers cannot now expect 10 or 20 months of bonuses in an extremely good year and negative bonuses the next year. I hope this is the case in practice now. Caveat, I am presuming that when the performance of the fund is over 20 years, then the bonuses and reward would also be measured over the same period and not on a year by year basis. I stand corrected.

This is one of Singapore's great creativity after being caught with their pants down in recent experiences when excessive bonuses were paid in one year and then suffering huge losses in the next, and unable to take back the bonuses paid out.

Another great Singapore creativity in using statistics is the way the population and employment statistics are being computed. Now there is very little reference or usage of the term 'Singaporean or citizen'. The population and employment statistics only use terms like residents, non residents, NOT Singaporeans/citizens versus PRs and non residents. And it seems that these new definitions are serving the govt's interest very well.

No one has any idea what is happening to Singaporeans and citizens, how they perform, their well being, vis a vis the non citizens like PRs and even new citizens. Singapore cannot be accused of lacking in innovative ideas and creativity when applying statistics is concerned. It is all done for the good of Singapore...and Singaporeans of course.

3 comments:

Fully agreed with what is highlighted by RB. It is also like taking survey of 1000 resident and come to the conclusion that 80% Singaporean are very happy with their life. Statistic are tools that our ruling politician like to used to con silly Singaporean.

Yes right you are Anon,

Recently quite a number of home and mails surveys by the MOM, PA, and even the SPF to ask and guage the response from the masses.

One poor lady at our door at nearly ten plus night asking whether we could help her with the survery just with her portly earning of $25.00 as all doors slammed onto her when she asked.

I said OK and invited her in. I said PA what's they surveying?

Initially, she said Activities and Sports for certain all ages groups.

OK that's fine.

But the question's come fast and thick with questions of what's you think of our present leaders and the new leaders.

Wow to gauge the masses response to the.comimg G.E.

These are their Surveys.

Oops forgot HDB also.

How's the environment and the Usefulness of your Estate.

NOT asking what's you think of the pricings?

The VERs?

Post a Comment