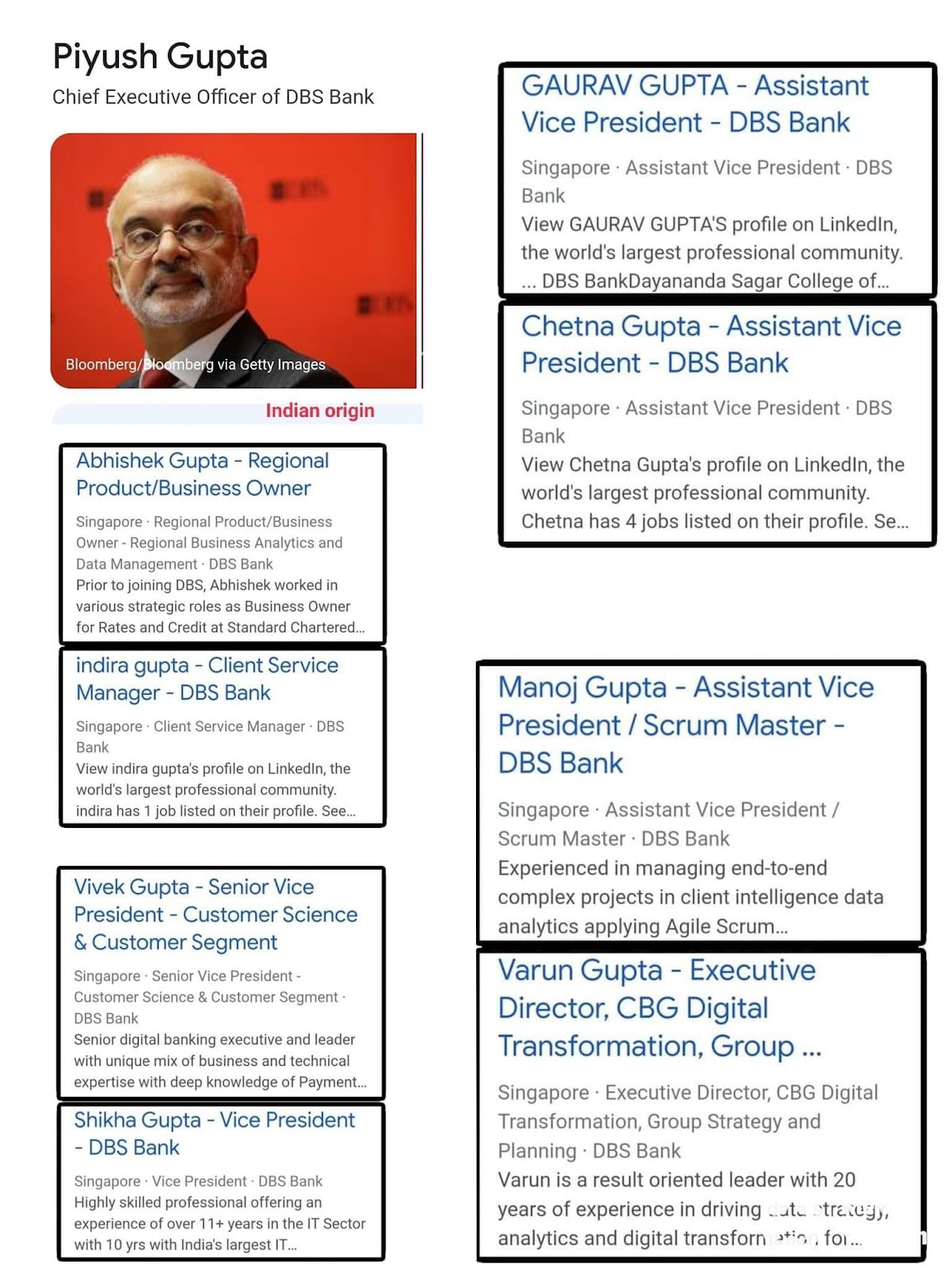

The modern day Guptas are everywhere and very successful in the US and UK and also Singapore. In Singapore alone, top of the Gupta heap is none other than the CEO of DBS, in Piyush Gupta. And there are many more Guptas in DBS as the above shown. Not sure how many Guptas are there in DBS and DBS India.

The Guptas seem to be very inclined in the banking profession. And Singapore is taking full advantage of their banking skills and talents and is recruiting as many Guptas as it can lay its hands on. No wonder DBS is now such a highly regarded bank, the top bank in the world. Without the Guptas, dunno where would DBS be today.

Having more Guptas must be a good strategy, not only having the best of the Gupta talents but also denying other banks and competitors from having the Guptas. This is the same political strategy of PAP, grab all the available talents to deny them from joining the opposition parties.

Good morning all..Guess how much HSBC made from their $1 purchase of SVB bank in their last quarter alone? how come with all the apparent talent in DBS n Temasick combined they couldn't drum up a bid? They only do abang adek type transaction la. The easy business of tapping into glcs n looking for abang adek merely means. the bank is layered with rows n rows of fat cats.

ReplyDeleteJjgg

Something seems very fishy when the CEO of DBS is a Gupta and in the senior ranks of the Bank there are 8 other Guptas and an unknown number of Guptas in the other ranks. Whiffs of nepotism and cronyism and unethical hiring practice are strong.

ReplyDeleteSmoking gun?

DeleteTrust them. They are very honest people. Nothing to worry about.

ReplyDeleteThe bank is in good hands. Our money is safe.

Bankers or Bangers?

ReplyDeleteShylocks or Slylocks as in "The Merchants of Venice"

Beware of your tons of flesh and blood.

First quarter already earned billions of dollars.

What's enterprising and hard works?

Just like SinPools, customer's just walked in without any prompting and advtgs.

BTO flats prices rises in tandem with incomes increases?

So a built up flat costs capital costs ten thousands must sell at 100k because you are earning 9k a month?

How about those earning 2K?

Also buy at 100K?

So all no choice but to head to the Slylocks to offer their pound of flesh and blood and Hope no die.

Wah, so many talented bankers. Maybe the Guptas are the new Rothschilds. From warrior class to banker class. How to compete against them with O level education.

ReplyDeleteWhen are they going to change name to Gupta Development Bank?

ReplyDeleteIn the Little Red Dot the name Gupta is very powerful in the banking sector. No degree from anywhere in the world can measure up to a Gupta. Doesn't matter whether the Gupta has a degree, genuine or fake, or not.

ReplyDelete

ReplyDeleteSingaporeans cannot keep quiet anymore. Why is our national bank DBS quietly and stealthily taken over by India Indians. Why and how is it DBS is filled with all Guptas? Has Pyush Gupta abuse his position as CEO of DBS to wrongly practise nepotism by feeling all the senior and well paid positions with his own kind. Besides these 9 Guptas in DBS the government mmust disclose fully in the mass media how many other Guptas or nationals from India are occupying other high or middle positions in the bank. Will DBS soon become the Gupta Developmment Bank of Bombay or India? Singaporeans must not allow that to happen. Has our Singapore monetary or financial authority been caught napping for allowing Pyush Gupta to recruit far too many of his Guptas to fill up all the senior positions in the bank. Nepotism should not be allowed to take place in Singapore. It is a form of corruption.

Boey Tiang Huat

ReplyDeleteSomething fishy is happening in the bank. Singaporeans must insist the government investigate and publish the result of the investigation without fear or prejudice.

Danaraj

Welcome to the blog, Boey Tiang Huat and Danaraj.

ReplyDelete

ReplyDeleteShould the present CEO be found to abuse his position he should be sacked and all his salaries and perks in past years should be confiscated retrospectively.

For security and propriety reasons, organisations normally disallowed too many staff that are related to work in the same place. To have so many Guptas in DBS must have raised a red flag. Common sense.

ReplyDeleteBut innocent and naive super talents would say nothing can go wrong, there is nothing wrong. Trust me, or trust them.

Ya, need to know exactly how many Guptas are there in DBS and DBS India and are they related.

ReplyDeleteWelcome to the blog, Goh Ta Pish.

ReplyDeleteWah lao! Why are so many posters unhappy that DBS is more successful than the other banks?

ReplyDeleteWah piang eh James, don't use arse and mouth to think lah !

DeleteWell meaning commenters are merely questioning why so many Guptas have been appointed to top level management in one bank, that is also the national bank. Are these Gupta buggers from same village, same familee tree ?

Do the appointments smell of nepotism, cronyism, insidious agenda ?

Is it prudent to allow DBS to be compromised ?

Of course LC heads will agree to any form of treachery so long they profit from it.

ReplyDeleteHas our national bank DBS been hijacked by India?

If Goh Keng Swee, Lim Kim San, S Rajaratnam, Hon Sui Sien, Sim Kee Boon and Lee Kuan Yew are still around this hijack of DBS by India or any foreign country will never happen.

Let's hope the spirits of Lee Kuan Yew, Goh Keng Swee, Hon Sui Sien, Lim Kim San, S.Rajaratnam and Sim Kee Boon will appear in an apparition before the guilty culprits who allowed that to happen and warn them of lethal consequences to them and their accomplices.

Tan Ghim Seng

ReplyDeletePiyush Gupta must be investigated by the authorities.

Ahmad Manaf

ReplyDeleteThe government should suspend the present CEO for six months while investigation on DBS is going on. In the interim oeriod the government can appoint a local banker to act as the CEO of the bank.

This is not a light affair. The authority should take local Singporeans views seriously and carry out a full thorough investigation, failing which Singapore as a financial center may face severe negative repercussions.

ReplyDeleteChen Mei Ling

Hi Tan Ghim Seng, Ahmad Manaf and Chen Mei Ling, welcome to the blog.

ReplyDeleteIf Singapore loses DBS or DBS got into serious trouble, don't blame Gupta. Singapore is doing it with eyes wide open and with many warnings by the public of the exposure to high risk.

On the other hand, some say big losses by some organisations are deliberate for their own hidden reasons.

Look at the Philippines, Marcos is inviting the Americans to deploy soldiers in his country. What is the difference?

ReplyDelete

ReplyDeleteREF: Anonymous 5:04pm

Hi!moron, you must be the same brainless idiot paid by the guilty parties to distract and divert attention from possible wrong doings. Don't put up a fictitious name as James AMK.If you so dare reveal your real identity.

Danaraj

Anyone in corporate management or risk management would raise a red flag when there are so many Guptas in DBS, and they are not Singaporeans or at best new citizens. Where is the security vetting?

ReplyDeleteThis is indeed a troubling sign.

This is an obvious case of taking on unnecessary and unacceptable risk. It could also be a case of irresponsible management.

ReplyDeletehttps://www.todayonline.com/singapore/dbs-digital-banking-services-disrupted-second-time-under-2-months-atms-also-affected-2164806

ReplyDeleteEmployed too many of their Fake Degrees IT country men that broke down too often?

My nephew NUS Honours Degree IT ex-VP asked to fry cuttlefish just before CNY.

Services decades with them.

Number One Bank AMK James?

Sure praised DBS as AMK ahem you know whose Constituency!

Good news, Virgo. Due to record profits, DBS is giving an extra dividend of $420 per 1000 shares on 10 May. This is in addition to the $920 they gave 2 weeks ago. You don't need to stay in AMK to buy DBS share. Even if you stay in Geylang, you can get the $1340 dividend.

ReplyDelete